While China still prohibits gambling by law, for players eager to play legally in Asia, there is a kind of oasis – Macau. Macau is one of the administrative regions of the PRC, but unlike all the others, the gambling business has been legal here since the 1850s, thanks to the Portuguese government, which granted the corresponding permission for its colony. Since 2001, mainly only gambling organizations and the infrastructure that supports them have been operating here, gambling has been the main source of income for Macau for many years now.

SlotsUp, as one of the most reliable online casino aggregators in the world, has prepared a comprehensive Macau gambling market overview for this year to help stakeholders make informed decisions on their investments.

Methodology

To make our overview objective and competent, we:

- analyzed publicly available independent web resources such as CLSA, Bloomberg, and Forbes;

- used financial analysis tools such as Yahoo Finance;

- took into account the opinion of the famous Chinese investment analyst Jeffrey Kiang and Morgan Stanley’s advisors.

Macau Gaming Revenue Trends in 2024

First of all, it should be noted that local legislation does not regulate the activities of online casinos, which means that such organizations are considered illegal in Macau. Therefore, let’s look at the figures related only to the land-based gambling sector.

In particular, due to the overall population growth, the expansion of the list of cities whose residents are eligible to participate in the Individual Visitor Program (which is about 45 million people in total), high demand in the premium segment, as well as competent marketing, the attendance of offline casinos in Macau is growing every year: in 2024, gross gambling revenue is expected to increase by 1.6 percent and exceed US$29.8 billion.

At the same time, due to such obvious growth, experts predict that gambling organizations will increase their budgets to provide an even more diverse gaming experience than ever, which will ultimately result in an increase in gross revenue by 3.2 percent (along with EBITDA, which promises to grow by 2 percent compared to 2019 the critical year for the gambling industry) by 2025.

Along with that, such inspiring prospects are likely to intensify competition between gaming providers: considering clear interest from potential stakeholders, which in the first quarter of 2024 alone was reflected in a 10 percent increase, they will be looking for new ways to attract their attention to their assets.

Comparison with Previous Years

As we have already mentioned, the most critical year in the last decade for the gambling industry worldwide was 2019 due to the COVID-19 pandemic. In particular, the offline gaming sector suffered the most – casinos around the world began to stand idle, and this especially affected gambling residences in China, which were subjected to some of the most severe restrictions, mostly connected with the strict border control measures with the mainland. That’s why, struggling with constant losses, the number of casinos in Macau has fallen by more than a quarter by 2022.

Fortunately, today, the pandemic is behind us, and Macau, like no other gaming capital in the world, is quickly recovering from the difficulties. For example, by the end of 2024, the number of visits to land-based gambling establishments will be approximately 14 percent higher than in 2019, and will likely reach 44 million 916 thousand. This, as we have already indicated above, is primarily due to the liberalization of the IVS, which increased the number of permitted regions to 59. Moreover, given that the second half of the year is expected to feature several outstanding holidays, including “Golden Week”, we can conclude that this figure (i.e., 44.916 bln) will be even higher than expected.

In general, positive dynamics are already observed nowadays: in May 2024, gaming revenue grew by 29.7%, amounting to $2.5 bln, and these are the best indicators since the tragic 2019.

There is also a relatively rapid recovery of the premium segment of players: their gambling activity brings in approximately 10% more income compared to the mass one.

As for the previous year, 2023, the gross revenue was estimated at almost 22.7 billion US dollars, which is 7.1 billion less than expected by the end of 2024. With Macau seeing its lowest gross gaming revenue since 2004 in 2022, at just US$5.3 billion, down 51.4% from 2021, we can conclude that this segment is finding resilience and is likely to reach new heights in the coming decade.

Regulatory Impact

Since the gambling sector is the main source of income for the Macau region, it is obvious that after the unexpected pandemic, the state urgently began to optimize the legislation regulating it. And now, in 2024, we can only see the stable growth and prosperity of this industry.

| Gaming type | Online | Offline |

| Casino gaming | Not applicable | DICJ (Gaming Inspection and Coordination Bureau in Macau) |

| Poker | Not applicable | DICJ |

| Bingo | Not applicable | DICJ |

| Betting | Not applicable | DICJ |

| Sports/horse race betting | DICJ | DICJ |

| Fantasy betting | Not applicable | Not applicable |

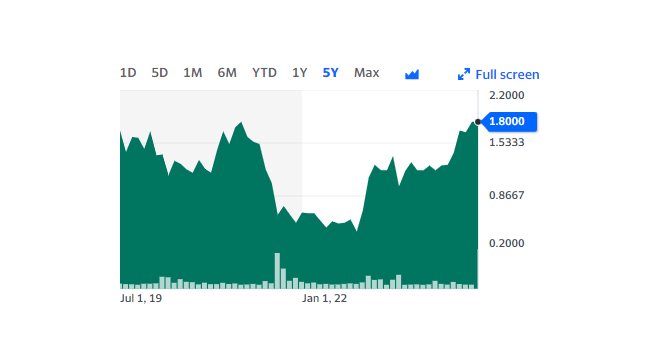

To understand how impressive this growth is, it is worth mentioning the outstanding example of MGM China, which, despite extensive opportunities for third-party financing and, in particular, through lending from its key shareholder MGM Resorts, refused them, relying solely on its income.

However, the regulation of VIP players is gradually tightening, which, as we can see from the analysis provided in the previous paragraph, can become a rather serious obstacle to profit maximization.

Year-End Outlook

If we talk about the leading players in the land-based casino market in Macau, they are the following:

- Galaxy Entertainment Group;

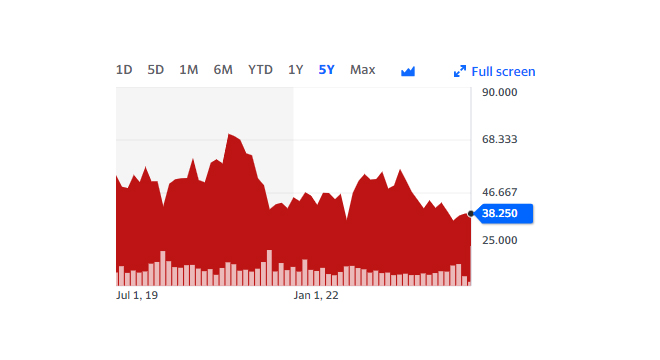

- MGM China Holdings;

- Sands China.

These are initially strong operators, which, along with SJM Holdings, Wynn Macau, and Melco Crown Entertainment, occupy the largest share of the Asian gambling market.

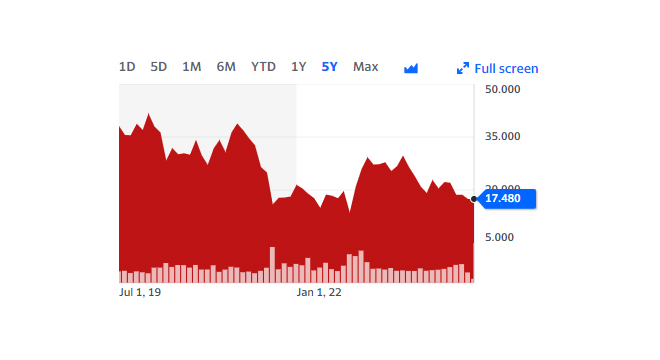

In particular, by the end of 2024, Galaxy’s share is expected to increase from 17.4% recorded in the first quarter of this year to 18.2%.

As for MGM, by the end of the year, its market share, on the contrary, will decrease from 17.2% (at the beginning of 2024) to 15.1%.

Finally, Sands will also most likely lose about 8% of its market share over the year. However, unlike its competitors, this company can regain its position by directing its budget towards capital expenditures, while the others will most likely face additional operating expenses, which will negatively impact their margins to varying degrees.

Conclusion

We hope that our overview has helped you understand the general state of the gambling market in Macau, as well as identify leading gambling operators whose assets are worthy of your attention from an investment point of view. In general, this Asian region is very attractive for stakeholders, so if you are considering it for long-term capital investments, there is definitely something to choose from.

If you want to get even more valuable insights on investing in the gambling industry, please visit the SlotsUp blog – you will definitely find a lot of useful information here.